What to do if Someone Hits Your Parked Car UK

Crowded car parks, tight car parking spaces and ever-growing vehicles on the road are unfortunately leading to more and more car park accidents. The growing number of cars and vans on the road means that parking prangs are now costing us more than £1.4 billion per year, according to Yahoo Finance UK! A separate piece of research, conducted by RAC Insurance, has found that a whopping two-thirds of British motorists have returned to their vehicle to find that their car was damaged in a car park, with an average bill of £2,050.

If you’re wondering what to do when someone hits your parked car, this guide is here to help. Whether someone hit your car and drove off, left a note, or scraped it without realising, these steps will help you handle the situation calmly and correctly.

Get your FREE Repair Estimate!

Step-by-Step Guide: What to Do If Someone Hits Your Car While Parked

If you have come back to your parked car to find it scratched or dented, then there are a few core steps to take. These steps will help you reduce the stress of not knowing what to do if someone hits your car.

Step 1: Check to see if there’s a note on your car

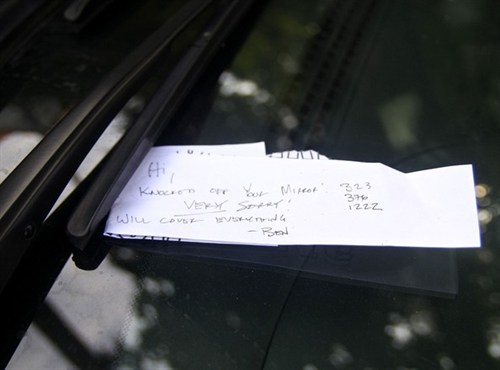

The first thing to do is check whether the person who hit your car has left a note. In the UK, it’s a legal requirement for a driver to provide their contact information if they hit a parked vehicle and the owner isn’t present. Ideally, the note should include their name, address, licence plate number, and a brief explanation. Failing to leave this information can lead to a penalty for hit and run on a parked car UK, including fines and points on their licence.

Unfortunately, RAC Insurance claims that only 9% of drivers actually leave a note, meaning that the vast majority of people are left wondering what to do if someone hit my car and drove off.

Step 2: Look for Witnesses or a CCTV Camera

If there is no note on your car, then you will be wondering ‘what to do if someone hits your car and drives off’. Well, the next best course of action is to look for a witness or a CCTV camera covering the area.

Ask witnesses if they saw the vehicle that hit your parked car and if they saw the licence plate number. Even better if they managed to note the licence plate of the car, then take their name, phone number and the licence plate. However, if there were no witnesses and you are parked in a supermarket or leisure centre car park, check to see if they have any CCTV cameras that could have covered the area you were parked in. If they do, then they may have caught who bumped your car on their system.

Step 3: Take Photos of the Damage

No matter whether there was a note, a witness, or a CCTV camera overlooking the accident, it is important to take clear and concise pictures of the damage that was attributed to your car when the other driver bumped or scratched it.

Take several clear, high-resolution photographs of the damage to your car, and the location of your car. These may come in handy when claiming insurance. If using a smartphone, it will be helpful that the photographs are location, time and date stamped as well. It all goes to help support your insurance claim.

Step 4: Assess the Damage

Before deciding on how to proceed, take a few minutes to assess the extent of the damage. Is it minor cosmetic damage like a scratch or dent, or is there a more serious issue that affects the safety or drivability of the vehicle? Take note of any leaking fluids, unusual noises, or parts that seem loose or misaligned. If you’re unsure whether the car is safe to drive, it’s best to call a breakdown service or have it towed to a garage for a professional opinion.

Step 5: Contact the Third Party

If you were fortunate enough to receive a note, reach out to the third party to discuss how to proceed. Often, the person who caused the damage may offer to pay for repairs directly to avoid making a claim. However, if you’re unsure or the costs are high, it’s wise to go through your insurer. If you’re wondering – someone hit my parked car whose insurance do I call – start by contacting your own insurance provider first.

Step 6: Report the Incident to the Police (if applicable)

If someone hit your car and drove off without leaving details, you should report the hit and run of a parked car UK to the police. Call the non-emergency number (101) to report it. You’ll receive a crime reference number, which may be required by your insurance provider. Also report the incident if you think the driver may have been under the influence or committed another offence.

Step 7: Contact your Insurance Company

If you do not have the details of the third party who hit your car and want to get the damage to your car repaired, you unfortunately only have two options. In the case that the person who damaged your car couldn’t be found, then you either must pay for the damage to be repaired or you can claim through your insurance company for them to pay for the repairs. If you decide to go down the latter route, and contact your insurance company, then it is worth noting that you may still have to pay the excess amount, so it is worth getting a quote for the repair cost before deciding.

Remember: that you will still need to inform your insurance of the minor damage even if you do not wish to make a claim. Many insurance companies have a rule that if you don’t tell them about the damage, it can invalidate your insurance policy.

Step 8: Arrange for the Repair

Once you’ve decided how you’ll be covering the cost—whether through your insurer, a third party, or out of pocket—you can arrange to have your car repaired. Choose a reputable garage, ideally one approved by your insurance provider if you’re making a claim. If you’re paying directly, it’s wise to get a few quotes to ensure fair pricing. Make sure to retain copies of all estimates, invoices, and repair records for future reference or claims.

What to Do If You Hit a Parked Car

Accidents happen—even when you’re manoeuvring slowly in a car park or reversing from a tight space. If you accidentally hit a parked car, it’s important to stay calm, act responsibly, and follow the right steps to avoid legal trouble and maintain your credibility.

- Stop and Stay at the Scene

By law, you must stop and stay at the scene after hitting a parked vehicle. Driving away without making any effort to contact the car owner could be considered a “hit-and-run,” which is a criminal offence that may result in points on your licence, fines, or even prosecution. - Try to Find the Owner

If the vehicle is parked near a building (like a house, shop, or business), make a reasonable effort to locate the owner. Ask inside nearby establishments or leave a note while you’re looking, so there’s evidence of your attempt to do the right thing. - Leave a Note with Your Details

If you cannot locate the vehicle’s owner, you are legally required to leave a clear and legible note on the windscreen with the following information: your name and contact number, your address, your vehicle registration number, a brief explanation of what happened. Also, take a photo of the note in place as proof that you left it. - Take Photos of the Damage and Scene

Photograph the damage you caused to the other vehicle as well as your own. Capture the position of both cars and any identifying details such as the location, weather, and lighting. These images will help protect you in case there’s a dispute later. - Inform Your Insurance Company

Even if you plan to pay for the damage privately and the other party agrees, it’s still advisable (and often required) to notify your insurer of the incident. If the other driver later changes their mind or makes a claim, you’ll be protected by having reported it from the beginning. Your insurer can also provide guidance on how to handle the situation properly. - Be Honest and Courteous

Accidents can be frustrating for everyone involved, but approaching the situation with honesty and a willingness to resolve it fairly can go a long way. Many drivers appreciate openness and may prefer to settle minor damage directly without involving insurers.

Remember: Hitting a parked car and failing to take responsibility can have serious legal consequences. If you leave the scene without providing your details, it may be classified as a hit-and-run offence, which could lead to fines, points on your licence, increased insurance premiums, or even prosecution depending on the severity of the incident.

Minor Car Body Repairs with ChipsAway

If your car was hit while parked on the street or in a busy car park, the experience can be frustrating. Whether someone hit your parked car and left, or you unknowingly hit a parked car, knowing the right steps to take is crucial to protecting yourself and your vehicle.

At ChipsAway, our specialists are capable of removing scratches from a car, operating from fully-equipped mobile workshops and fixed-base Car Care Centres – we can save you both time and money! It is often the case that our repairs come in cheaper than your car insurance excess. Request your free, no-obligation estimate online.